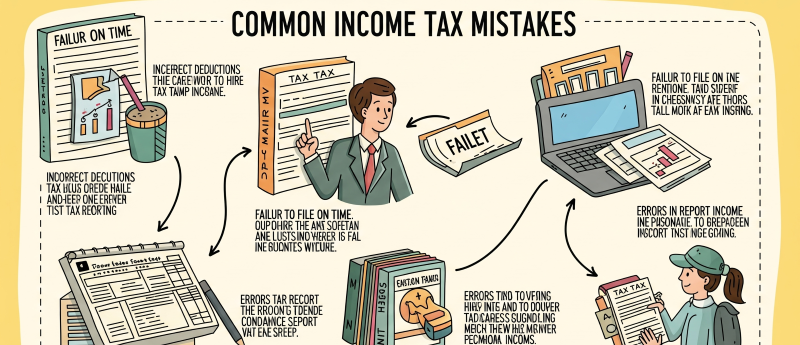

1) Choosing wrong ITR form

2) Quoting wrong assessment year

3) Non-verification of TDS details with Form 26AS

4) Non-declaration of all bank accounts

5) Filing ITR without using all sources of income

7) No reporting of income from investments such as interest income

8) No clubbing of minor’s income

9) Non Giving Details of Foreign Income

10) Non Verification of AIS

CA Laxman Dabholkar

https://youtu.be/BsccKYldcSg